Team Diva has made following Washington state’s education crisis a priority for our give back to the community this spring. As many of you know, we have highlighted the efforts of grassroots organization Washington’s Paramount Duty. As the bedrock of a functioning democracy and economy. Education policy should be a priority for us all.

Washington’s Paramount Duty Leads the Statewide Fight for Education Rights

At the federal level, the country is seeing a concerted effort by the Republican administration to dismantle public education entirely. It’s more important than ever that we as a state support our schools and the future of our students.

The Crisis in Review

Divaland Bands Together to Support Education Funding in WA State

In 2012, the state Supreme Court’s McCleary ruling stated that Washington is violating its constitution by failing to cover the full cost of a basic public education. In 2015, the state was found in contempt of this ruling and began racking up $100,000 per-day fines. The justices then ruled that a full education plan must be enacted by 2018.

Also in 2015, lawmakers argued that the 2014 voter-approved I-1351 could not be implemented for lack of funds. That initiative demanded reduced class sizes for K-12 and called for a staff hiring boost. The legislature voted to delay everything but class-size reductions for grades K-3.

Over the last few years, countless assessments have been done. The notion was that before more funds were spent, the state had to determine if the funds were being used responsibly. That’s fair enough. But years—and billions of dollars later. Education is still not fully funded in Washington state.

Both sides agree that additional taxes or levies are necessary. The nature of those taxes and how the money is spent is what differs widely. It’s time to review the options and what they mean for homeowners.

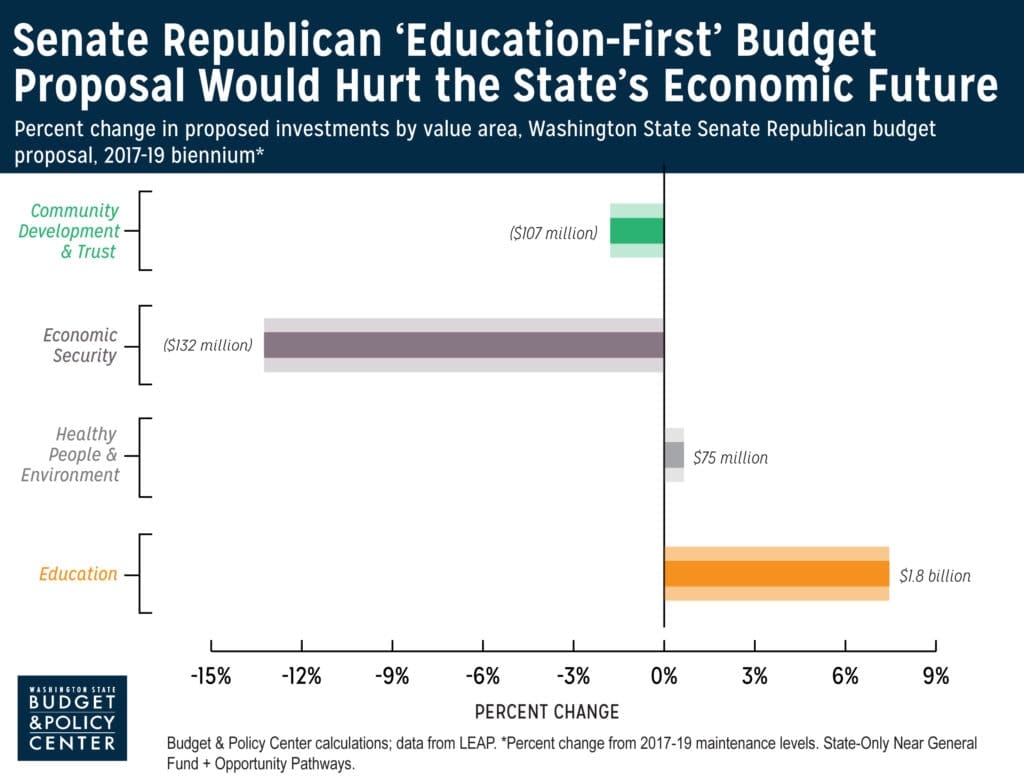

The Republican Senate’s Plan

We’ll be blunt. We knew there would be a lot to dislike in the Republican plan. Just based on how dismissive and antagonistic its leaders have been toward our education system. It could be worse, but it has a lot of predictable problems. Senator Reuven Carlyle (D, Seattle) may have said it best when he called the new proposal a “shell game.”

Key in the republican plan is to INCREASE homeowner’s taxes and gut social programs like healthcare, housing, Medicaid (aka Obamacare), etc. Our question is once again why do homeowners need to carry the brunt of education funding when large developers pay ZERO in capital gains when they sell a huge development project? Is this fair?

In essence, the proposed $1.4 billion for education will be re-allocated from other state programs (e.g. Medicaid) and specific districts (Seattle). Senator Carlyle notes that property taxes will increase in the greater Seattle metropolitan area while decreasing in others. Chief GOP budget writer Sen. John Braun (R, Centralia) estimates that the average property tax increase in Seattle will be $250 annually.

That said, the plan also includes policy concepts that are worthy of debate. Inspired by the Massachusetts budget model. The GOP plan would guarantee a minimum of $12,500 per student, with extra funds available for special needs and low-income students. Schools would be funded based on their student population.

Meanwhile, teachers would see a bump in salary and become eligible for performance-based bonuses and housing allowances. The plan would also prevent teachers from striking and make it easier to fire them. No surprise: the teachers union is not too pleased with that last part. Seeing the plan as laying the groundwork for a lot of other bad policy. Voters should take note, too: The GOP plan demands a full repeal of I-1351.

The Governor’s Plan

Rather than cutting funding for other vital services in the state. Governor Jay Inslee’s education funding plan would raise tax revenue. Those funds would come from new taxes on carbon emissions and capital gains. Plus an increase in the state business-and-occupation tax.

The total increase to the state operating budget through taxes would be $4.4 billion for 2017-19. Over half of it would provide for teacher and school-worker salaries: around $2.75 billion over two years. Of the three plans, the governor’s presently offers the most significant increase in funding for education professionals to encourage retention and performance.

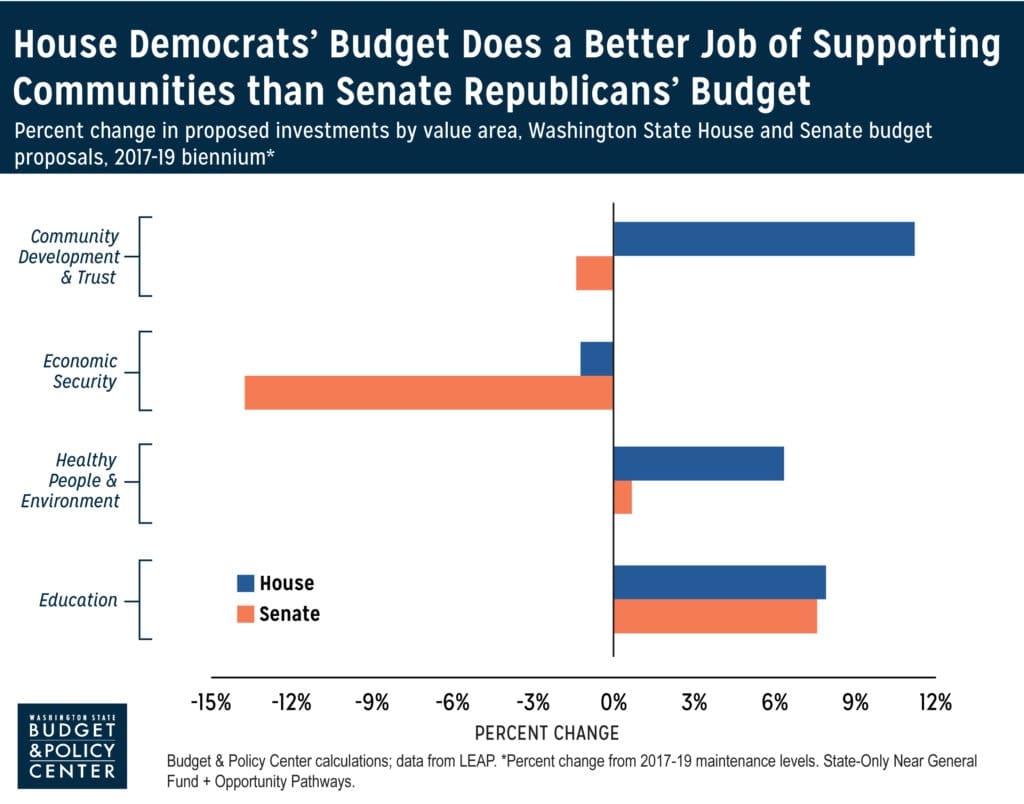

The State Democrat’s Plan

Like the Governor, the Democratic legislators also consider a capital-gains tax and carbon pricing as potential revenue sources to fund their $7.3 billion proposal. However, they would also increase property taxes state-wide (rather than singling out just the Seattle area). Overall, the state democrats’ plan does the most to support our communities and is fair and equitable.

Washington State Budget and Policy Center did a great breakdown of the democrats plan on their blog this week.

- Curtailing or eliminating five wasteful business and sales tax breaks ($137 million);

- Modifying the 1 percent levy growth limit to allow property tax revenues to keep better pace with economic drivers ($128 million);

- Closing the tax break on profits from high-end capital gains ($715 million);

- Reforming business taxes to strengthen small businesses ($1.2 billion);

- Rebalancing the Real Estate Excise Tax to make it more progressive ($420 million); and

- Creating a more level playing field between in-state and out-of-state retailers ($340 million).

This plan earmarks $1.6 billion over two years for teacher and school-worker salaries. That’s significantly less than Inslee’s plan, but more than the GOP plan.

How Can You Make Sure Education is Fully Funded in WA State

Part of the fundamental problem in the state is that individual districts (and schools) have been forced to raise funds locally to cover budget shortfalls. This has disadvantaged low-income neighborhoods. Hence the McCleary case that led to the ruling behind this long overdue legislative interest in resolving our educational crisis.

So what will become of those local levies? At present, many legislators want to see them go away entirely. The GOP plan caps how much can be raised through them.

We believe that the quality of one’s education should not be especially contingent on one’s zip code. We also believe that because this issue affects everyone (whether you have kids or not), it is vital that we all take action.

Washington’s Paramount Duty has a page that helps you get started by contacting your representative. (You might also consider contacting other reps, like Braun, if you are especially passionate.) See that page here. If you want to support WPD directly, you can also donate online.

Be cool: Support our schools!